We’d love to send you money-off vouchers, exclusive offers and the latest info from Attwoolls Outdoors by email. We’ll always treat your details with the utmost care and won’t share them with any third party. You can, of course, opt out of these communications at any time! See our Privacy Policy for more info.

Terms of Use

Website Usage Terms and Conditions

Welcome to our website. If you continue to browse and use this website you are agreeing to comply with and be bound by the following terms and conditions of use, which together with our privacy policy govern Attwooll’s relationship with you in relation to this website.

The term ‘Attwoolls’, ‘John Attwooll & Co (Tents) Ltd’, ‘us’ or ‘we’ refers to the owner of the website whose registered office is John Attwooll & Co (Tents) Ltd, Bristol Road, Whitminster, Glos, GL2 7LX. Our company registration number is 802641. The term ‘you’ refers to the user or viewer of our website.

All prices are in £ sterling and are inclusive of VAT at the current rate. Payment can be made by any major credit/debit card.

All credit/debit card holders are subject to validation checks and authorisation by the card issuer. If the issuer of your payment card refuses to authorise payment to us, we will not be liable for any delay or non-delivery.

The use of this website is subject to the following terms of use:

- The content of the pages of this website is for your general information and use only. It is subject to change without notice.

- Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and materials found or offered on this website for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law.

- Your use of any information or materials on this website is entirely at your own risk, for which we shall not be liable. It shall be your own responsibility to ensure that any products, services or information available through this website meet your specific requirements.

- This website contains material which is owned by or licensed to us. This material includes, but is not limited to, the design, layout, look, appearance and graphics. Reproduction is prohibited other than in accordance with the copyright notice, which forms part of these terms and conditions.

- All trademarks reproduced in this website, which are not the property of, or licensed to the operator, are acknowledged on the website.

- For card security reasons payment may be debited before the contract is formed. If your order is cancelled by either party or ultimately rejected for any reason, a full refund will be made immediately using our secure online payment processing system. For the purposes of this agreement the dispatch of your order from our warehouses constitutes our acceptance of your order.

- While we try and ensure that all prices on our website are accurate, errors may occur. If we discover an error in the price of goods you have ordered we will inform you as soon as possible and give you the option of reconfirming your order at the correct price or cancelling it.

- Unauthorised use of this website may give rise to a claim for damages and/or be a criminal offence.

- From time to time this website may also include links to other websites. These links are provided for your convenience to provide further information. They do not signify that we endorse the website(s). We have no responsibility for the content of the linked website(s).

- You may not create a link to this website from another website or document without Attwooll’s prior written consent.

- Your use of this website and any dispute arising out of such use of the website is subject to the laws of England, Scotland and Wales.

- Persons under the age of 18 should use this website only with the supervision of an adult. Payment information must be provided by or with the permission of an adult.

- Accounts – In order to purchase goods on this website you can create an account which will contain certain personal details and payment information which may vary based upon your use of this website as we may not require payment information until you wish to make a purchase. By continuing to use this website you represent and warrant that:

- all information you submit is accurate and truthful.

- you have permission to submit payment information where permission may be required.

It is recommended that you do not share your account details, particularly your username and password. Attwoolls accepts no liability for any losses or damages incurred as a result of your account details being shared by you. If you use a shared computer, it is recommended that you do not share your account details in your internet browser.

V12 Finance - Terms of Use

We offer our customers the ability to apply for simple finance facilities to fund a purchase from us, simply add your items to the basket and then select the V12 Retail Finance option at the checkout. Once you are accepted by V12 Retail Finance you will be asked to ESign the credit agreement and once in receipt of your purchase, V12 will make your agreement live and your monthly repayments will commence for the agreed term. This finance option gives you the flexibility to buy what you really want now and enjoy your next camping trip or adventure by spreading the cost of your total purchase over a repayment period that suits your budget.

ALL FINANCE ORDERS MUST BE DELIVERED TO THE ADDRESS REGISTERED IN YOUR FINANCE AGREEMENT (HOME ADDRESS), IF THIS IS NOT SUITABLE THEN PLEASE DO NOT CHOOSE TO CHECKOUT USING FINANCE - Simply checkout using Sage pay instead or visit us in store, use the V12 Finance option and take your goods away with you.

FINANCE AVAILABLE ON ALL ORDERS FROM £500 UP TO £25,000

The online finance option we offer is:

- 3 Months - Interest Free Credit at 0% APR representative (with the option of paying an initial deposit) (£500 - £1,000 Only)

- 6 Months - Interest Free Credit at 0% APR representative (with the option of paying an initial deposit)

- 9 Months - Interest Free Credit at 0% APR representative (with the option of paying an initial deposit)

We do not require a deposit, however if you would like to pay a deposit then this is available when you chose the V12 Retail Finance option when purchasing your goods in store.

The instore finance option we offer is:

- 3 Months - Interest Free Credit at 0% APR representative (with the option of paying an initial deposit) (£500 - £1,000 Only)

- 6 Months - Interest Free Credit at 0% APR representative (with the option of paying an initial deposit)

- 9 Months - Interest Free Credit at 0% APR representative (with the option of paying an initial deposit)

FINANCE PRODUCT INFORMATION

Interest Free Credit

- This is an interest free loan with no arrangement fees

- You repay the loan amount through 3, 6, or 9 equal monthly payments

- Minimum order value needs to be £500 or more (no deposit required)

AM I ELIGIBLE FOR FINANCE?

You must:

- Be at least 18 years of age

- Have been a UK resident for 3 years or more

- Be able to make repayments by direct debit

- Be in regular employment* (minimum of 16 hours per week) including self-employment, or in permanent residence with your spouse/partner who is in regular employment.

*If you are retired and receive a pension or registered disabled and unable to work, V12 Retail Finance may ask for proof of sufficient income.

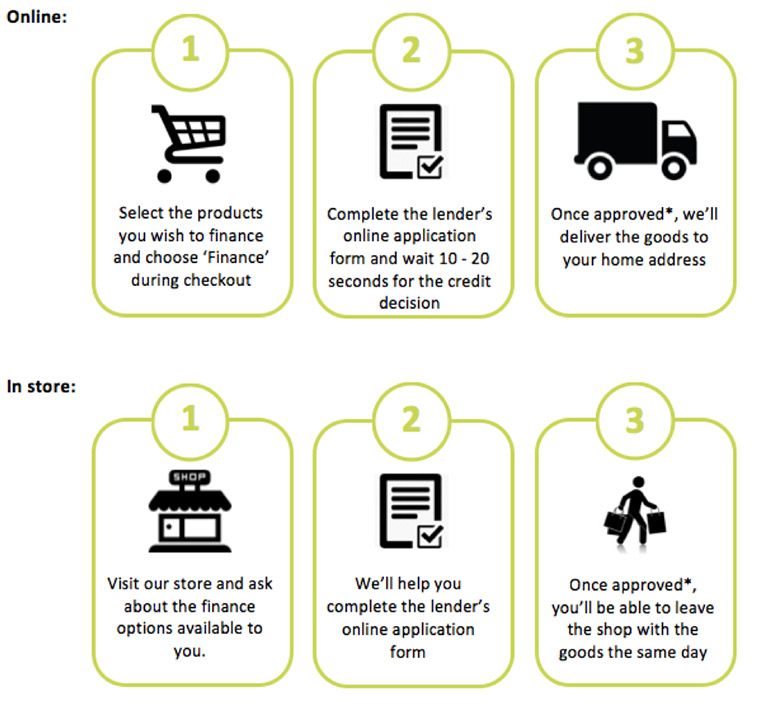

HOW DO I APPLY FOR FINANCE?

*Credit is subject to age and status. You must agree to the lender’s Terms and Conditions and electronically sign the Credit Agreement document before we can release the goods to you.

WHAT INFORMATION DO I NEED TO APPLY FOR FINANCE?

During the finance application you will be asked for certain personal information:

- Name

- 3-year address history

- Date of birth

- Email address

- Telephone contact details

- Employment / income information

If you are accepted you will also need a credit or debit card registered to you at your address on the credit application so that the lender can carry out an electronic identity check.

HOW LONG DOES IT TAKE TO APPLY?

With most applications we expect that you will be given an acceptance or decline decision within 10-20 seconds. With some applications the lender may return the decision as ‘referred’. You will then receive an email with further instructions once the underwriters have come to a decision. For in store applications you can usually wait in the shop whilst the underwriters review your application. Underwriting hours are between 8am and 8pm, Monday to Friday (excluding Bank holidays), 9am and 6pm on Saturday, and 10am and 5pm on Sunday. If your application is referred outside of these hours then you may have to wait until the next working day for the decision.

DELIVERY INFORMATION

For finance orders made online we are only able to deliver the goods to the address on your credit agreement (your home address). You will not be able to have the goods shipped to another address or collect the goods from us in person. V12 Retail Finance is available in store if you would prefer to collect goods from us in person.

WHAT IF I NEED TO RETURN MY ORDER?

If you wish to return the order then please refer to our Returns Policy. If we accept your return we will contact the lender to cancel the credit agreement. We may not able to cancel the finance if the return falls outside of our returns period.

MY APPLICATION HAS BEEN DECLINED, WHY IS THIS?

You will be informed of the decision if the lender declines your application, the lender is unable to share the reason for decline with Attwoolls Camping & Leisure. Applications are usually declined for reasons such as:

- You do not meet the eligibility criteria (see above);

- Adverse credit reference agency information;

- Your credit score;

- You are considered to be overcommitted; or

- Your existing account performance with other lenders.

The lender will give you the contact details for the credit reference agency used. They will also give you information on how to appeal the decision if you wish to discuss the matter. Please note that the lender is unable to discuss this over the telephone due to Data Protection rules. You should also note that each lender applies its own credit score to applicants so if you have recently been accepted for credit elsewhere this does not necessarily mean that appealing the decision on this basis alone will result in a change of decision.

CUSTOMER COMPLAINTS

If any customer has a complaint, they must bring it to our attention by either:

- Telephoning 01452 742 233

- Calling into our store

- Emailing aftersales@attwoolls.co.uk

Where our customer complaints department with be dealt with by our manager Doug Loveday or Chris Attwooll

THE LENDER

Attwoolls Camping & Leisure acts as a credit broker and only offers credit products from Secure Trust Bank PLC trading as V12 Retail Finance.

Secure Trust Bank is registered in England and Wales 541132. Registered office: Yorke House, Arleston Way, Solihull, B90 4LH. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registration number: 204550.

Attwoolls Camping & Leisure is registered in England and Wales - 802641. Registered Office: Whitminster Lodge, Whitminster, Bristol Road, Gloucestershire GL2 7LX UK.